Coinbase Agentic Wallets

Executive Summary

This report analyzes Agentic Wallets, a new crypto wallet infrastructure launched by Coinbase in February 2026 that enables autonomous AI agents to hold, manage, and transact funds on-chain without requiring human intervention. It examines why the product was developed, how it operates, key features (including the x402 payment protocol and programmable guardrails), potential use cases (autonomous DeFi, machine-to-machine payments), and risks & limitations (security, regulatory uncertainty). The report draws on primary sources including Coinbase’s official documentation and independent media coverage. (Coinbase)

1. Introduction / Background

AI agents have matured from static tools that answer questions to dynamic systems capable of executing workflows and decisions based on real-time data. However, until 2026, enabling agents to perform financial actions such as executing a trade, paying for API calls, or rebalancing a portfolio required human approval. This barrier has restricted the development of fully autonomous decentralized finance (DeFi) and agentic commerce. Agentic Wallets aim to remove that bottleneck by giving agents a native on-chain wallet and programmable financial capabilities. (Coinbase)

2. Technical Overview

2.1 What Are Agentic Wallets?

Agentic Wallets are wallet accounts designed specifically for AI agents, enabling autonomous holding and management of digital assets (e.g., stablecoins like USDC), trading of tokens, and execution of programmable transactions on blockchain networks. Unlike conventional wallets controlled by humans, these wallets are controlled by software agents within predefined boundaries. (docs.cdp.coinbase.com)

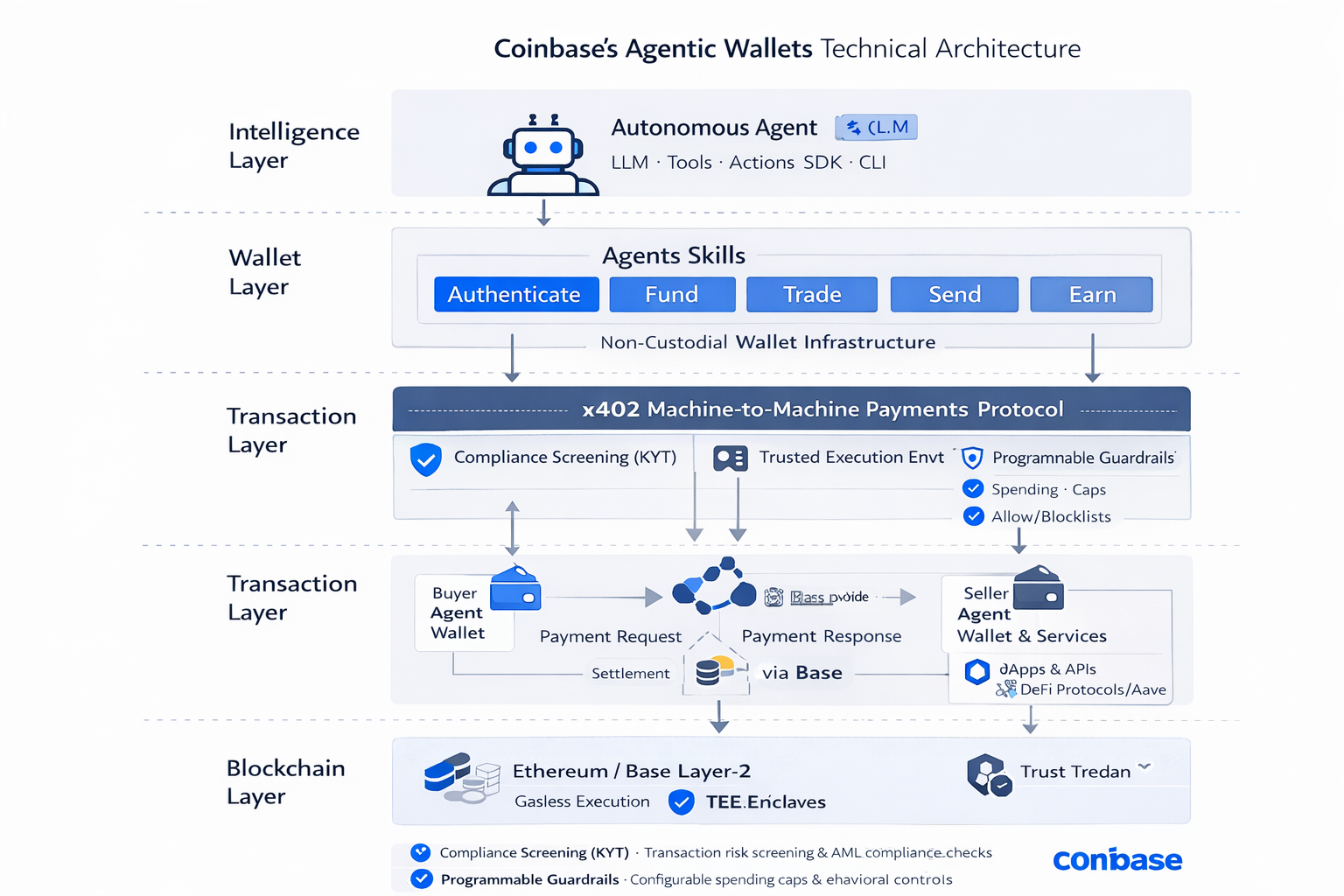

Structurally, Agentic Wallets integrate with the Coinbase Developer Platform (CDP) and consist of:

- Stand-alone non-custodial wallet infrastructure where agents hold funds independently.

- Plug-and-play agent skills, abstracted capabilities such as Authenticate, Fund, Send, Trade, and Earn, which simplify blockchain interactions.

- Integration with the x402 payments protocol, a machine-to-machine payment standard optimized for programmatic financial activity. (Coinbase)

2.2 The x402 Protocol

At the core is x402, described by Coinbase as a purpose-built protocol for autonomous AI financial operations with over 50 million transactions processed. This standard enables agents to perform machine-to-machine payments, pay for APIs and compute, and transact without human intervention. Importantly, x402 embeds payments into web-native interactions such as HTTP requests, turning common web calls into transactional opportunities for autonomous agents. (Coinbase)

2.3 Security and Guardrails

Autonomy does not imply unlimited control. Agentic Wallets include programmable guardrails:

- Session caps and transaction limits to control spending per session or per transfer.

- Private key isolation via Trusted Execution Environments (TEEs), preventing direct extraction of keys by an agent or an LLM.

- Know Your Transaction (KYT) compliance screening that automatically blocks high-risk interactions. (Coinbase)

These safeguards aim to balance autonomous operation with compliance and risk management, critical for enterprise adoption.

3. Data & Evidence

| Feature | Description | Source |

|---|---|---|

| Wallet Type | Autonomous agent wallet (non-custodial with TEE key isolation) | Coinbase Documentation (docs.cdp.coinbase.com) |

| Payments Protocol | x402 machine-to-machine standard | Coinbase Blog (Coinbase) |

| Deployment Time | Setup & funding in under 2 minutes | Media reporting (MEXC) |

| Network Support | Base Layer-2 (gasless trading) | Multiple media (Coinbase) |

Deployment Workflow: Developers can use the command-line tool (npx awal) to deploy and configure agent wallets quickly, enabling agents to start financial operations within minutes. The wallet supports gasless trading on Base, Coinbase’s Layer-2 network, removing gas cost barriers and allowing 24/7 operations. (Coinbase)

4. Case Studies / Examples

Example Use Cases:

- Autonomous DeFi Operations: Agents that automatically rebalance liquidity positions or optimize yield across protocols without human monitoring.

- Machine-to-Machine Payments: Agents paying for compute, APIs, or storage in a machine economy where services are bought and sold autonomously.

- Agentic Commerce: Agents participating in creator economies, earning yields, tipping services, or selling generated content. (Coinbase)

These example scenarios illustrate how autonomous wallets could underpin a new ecosystem of agent-driven financial activity, transforming automation beyond static tasks to real economic participation.

5. Discussion & Implications

Agentic Wallets represent a shift in both AI autonomy and blockchain utility:

- They bridge software automation and on-chain financial capabilities, enabling agents to act as independent economic actors.

- Supporting gasless operations addresses a classical pain point in autonomous agents (insufficient fees halting activity).

- Programmable controls help align autonomous activity with compliance and enterprise risk policies.

Strategic Implications:

- For Developers: Simplifies building autonomous financial agents with reusable skills and command-line tools.

- For Enterprises: Offers programmable automation subject to spending limits and compliance checks.

- For Blockchain Ecosystems: May accelerate on-chain activity and the emergence of machine-economies dominated by software agents. (MEXC)

6. Challenges & Risks

Despite the promise, several limitations or uncertainties remain:

- Regulatory Clarity: Autonomous agent financial liability and legal frameworks for agent-held assets are currently undefined. (AInvest)

- Security Complexity: Although private keys are protected in TEEs, autonomous access must be carefully audited to prevent misuse.

- Adoption Milestones: Broad adoption depends on developer uptake and ecosystem maturity beyond early pilot cases.

7. Conclusions & Recommendations

Agentic Wallets mark a significant milestone in autonomous finance:

- They enable a new class of agentic applications previously restricted by financial dependency on humans.

- Built-in security and compliance features support enterprise viability.

- Outcome potential spans DeFi automation, autonomous commerce, and machine-to-machine financial ecosystems.

Recommendations for Stakeholders:

- Developers: Explore early integration with x402 and Base for experimental autonomous agents.

- Enterprises: Evaluate programmable guardrails alignment with compliance needs.

- Regulators: Engage in frameworks to clarify liability and risk around autonomous financial agents.

References

- Introducing Agentic Wallets: Give Your Agents the Power of Autonomy — Coinbase Developer Blog (Click to source) Coinbase Agentic Wallet Launch Details

- Agentic Wallet Documentation — Coinbase CDP Docs (Click to source) Coinbase Agentic Wallet Developer Docs

- Coinbase Launches Agentic Wallets to Enable Autonomous AI Transactions — MEXC News (Click to source) MEXC News Coverage of Agentic Wallets

- Coinbase unveils crypto wallets designed for AI agents — Cointelegraph (Click to source) Cointelegraph on Agentic Wallets

- Security and x402 Protocol Insights — CryptoView.io (Click to source) Security and Payments with x402